The Difference Between Saving And Investment: As the old saying “Savings help you in bad hours,” but have you ever considered investing your money for the best times? If you need clarification on whether it’s time to start investing or focus on saving, the solution depends on your goals, risk tolerance, and financial situation.

Table of Contents

ToggleThe Difference Between Saving And Investment

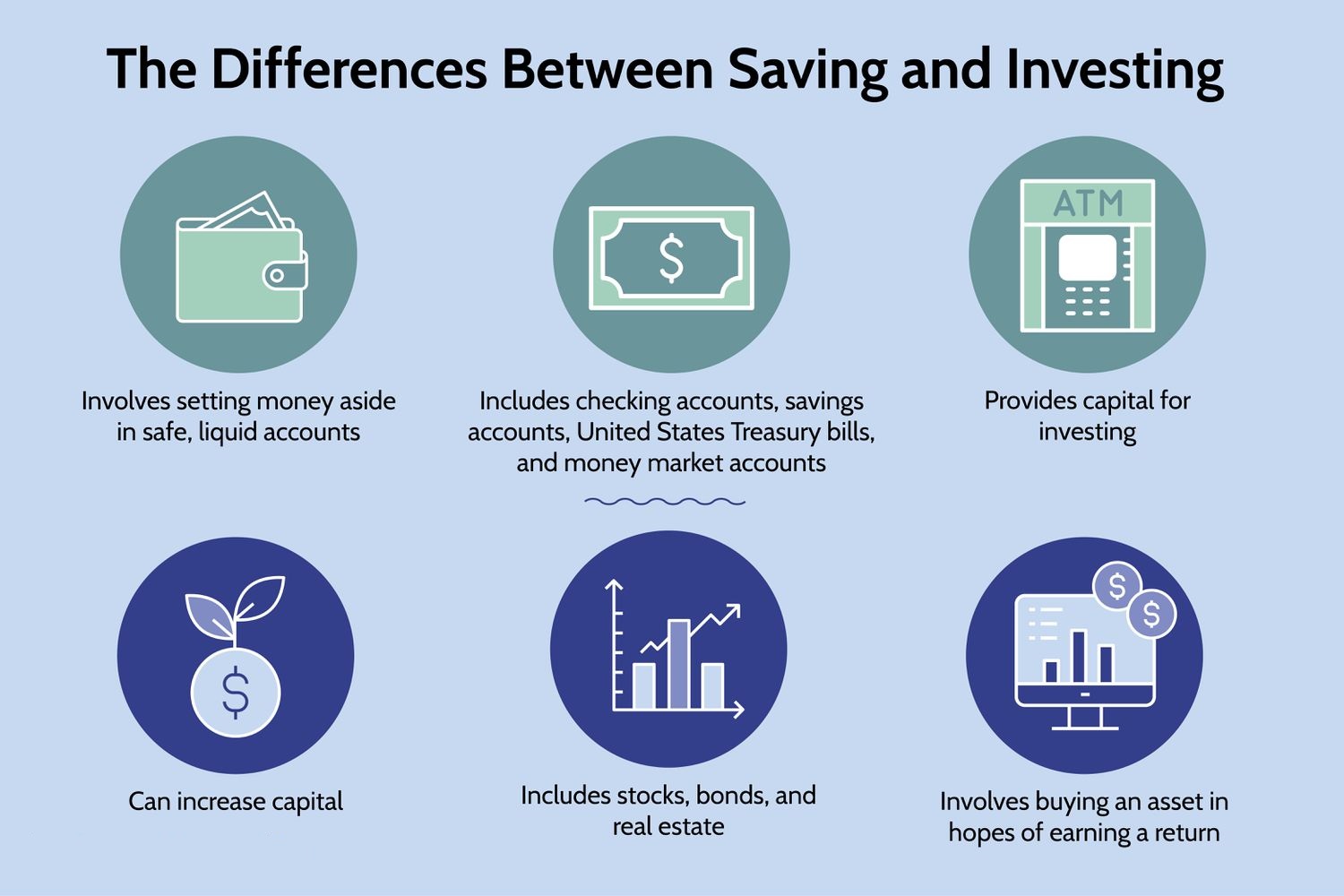

- Saving — gradually putting your hard-earned money aside, typically into a bank account or some form of committee. People generally save for a particular goal, like paying for a car, a down payment on a house, or any emergencies that might come up. Saving can also mean putting your money into products like a bank time account (CD).

- Investing — using some of your money to help it grow by buying assets that might increase in value, such as stocks, real estate property or shares in a mutual fund.

Price Is What You Pay, Value Is What You Get.

Should you invest or save now or wait?

We always stuck over the difference between saving and investment. You may want to consider starting your investment strategy after you have:

- Build your emergency savings. Savings should come first. Before investing, try to ensure you have a separate low-risk, low-return account to cover expenses during an unforeseen event — typically at least three to six months’ worth of living expenses.

- Paid off high-interest debt. By paying off high-interest debt in full, you’ll reduce the total amount you owe faster and free up money to put toward savings or investing.

- Maxed out your 401(k) and IRA. Suppose your long-term goals include a comfortable retirement, and you already contribute the maximum amount to your retirement accounts. In that case, exploring additional investment types may be an appropriate time.

The Difference Between Saving And Investment

Saving and investing are two essential financial concepts that often go hand in hand. While both involve setting aside money for future use, their purpose, strategies, and potential returns differ but there is a difference between saving and investment. When you save money, you mitigate risk but also compromise on the ratio of reward you may earn. Similarly, when you opt for investments, you may be subjected to higher risks, but the rewards are also very high.

Saving | Investment |

The primary purpose of saving is to set aside money for short-term goals or emergencies. Savings are typically held in easily accessible accounts, providing financial security for unexpected expenses. | Investments are made to generate a return over the long term. Investors aim to grow their wealth and achieve financial goals such as retirement, buying a home, or funding education. |

| Short to medium-term. Savings are often for goals expected shortly, such as a vacation, a down payment on a car, or an emergency fund. | Long-term. Investments are intended to grow over an extended period, focusing on capital appreciation. Long-term investments include stocks, bonds, and retirement accounts. |

| Generally low risk. Savings are usually held in low-risk, easily accessible accounts, such as savings accounts or certificates of deposit (CDs), to preserve capital. | Involves varying degrees of risk. Investments can range from low-risk options like government bonds to higher-risk options like stocks. Risk tolerance depends on the individual’s financial goals and willingness to withstand market fluctuations. |

| Offers minimal returns. While savings provide a haven for funds, the interest rates are typically lower than potential investment returns. | Offers the potential for higher returns. Investments involve putting money into assets that have the potential to appreciate over time, providing a greater return compared to traditional savings. |

| Easily accessible. Savings are kept in liquid assets, allowing quick and convenient access to funds when needed. | Access may be restricted. Certain investments, especially retirement accounts or fixed-term investments, may have restrictions or penalties for early withdrawals. |

| Forms the foundation for financial stability and provides a safety net for unexpected expenses. | Plays a key role in wealth creation and achieving long-term financial goals. |

Where to Save or Invest?

When saving money, look for a place that keeps your hard-earned money safe and liquid (readily available whenever you need to use or sell), e.g. banks, securities, prize bonds, etc.

On the other hand, when you invest the money, you normally purchase an asset that reaps mid-long-term benefits in the form of dividends, profits, and overall asset appreciation. One of the most popular investment opportunities is Real Estate. Other investments may include stocks and shares. It’s always where one should invest in a discussion, whether it’s stocks or real estate.

What Are The Returns On Investment And Saving?

In the case of savings, the returns are usually less. You normally park your money in a bank and earn little returns. Different savings accounts have different interest rates. Pakistan, a developing country, has a much higher percentage of interest rate than other countries. However, the average rate of return worldwide is around 0.9% annually.

Investments yield a much higher ROI because of the nature of the investments involved. For example, real estate yields good returns in a short period. On average, you can earn high returns monthly, quarterly and annually in real estate investments. Check out some real estate projects by top construction companies that can get you 20%+ annualized returns.

What Are The Risk Factors of Investment And Saving?

Savings come with no or minimal risk. Why?

When you put your money in a savings account, you are not compromising on your principal amount. In layperson’s terms, when you put aside Rs.1000 as savings, it will not become Rs.900 because you are not giving it to someone for business or further investment.

Investment comes with risk because when you invest your money, you give it to someone else. But it would help if you also kept the difference between saving and investment in mind that despite having a high-risk factor, investment yields higher returns.

Nature of Products

One needs tangible/ intangible assets and products to invest/save money.

If you want to save money, you can put the money in savings accounts at any bank. A savings account allows you to secure your money and provide interest on your deposits.

Similarly, there are many investment opportunities out there. You can invest in bonds, gold or forex trading; the choice is all yours. These investments are considered to be the best investments in Pakistan. Similarly, investing in business will allow you to meet your financial goals.

Capital Requirements

Usually, savings can start from a low capital. You can start saving every month from as low as Rs.1000. Similarly, investments can start from less capital, such as shares and prize bonds. Some shares may cost you Rs.100 only.

However, if you want higher returns, you should invest in more expensive assets such as real estate and gold. There are multiple options for real estate available in the market, each with distinctive features. The ‘commercial real estate vs residential real estate’ debate, whether to invest in a shop or a house, is always under the limelight.

Liquidity

By liquidity, we mean the ease of converting an asset into cash. In general, both savings and investments have high liquidity. However, savings have slightly higher liquidity because you can easily get cash whenever needed. You might have to wait a bit for investments because you may need time to sell off your investments to get cash.

Purpose

People often mistake savings with investments because they are not aware of the difference between saving and investment, whereas, in reality, these two have very different end goals. People save money to gain short-term financial goals. For instance, you may want to save for the new car you always wanted to buy, or you might want to save for the renovation of your property.

On the other hand, people usually invest when they want to earn good returns, grow their money or want capital formation.

Growth Potential

When you save money, you do not contribute towards the growth of your wealth. It would help if you spent a certain amount of money now. In short, the growth potential with savings is quite low.

On the other hand, investments come with high growth potential because when you invest in something, you are giving money to someone and in return, you are expecting some returns. If you are investing in real estate, always research tax on property.

Interest vs Profit

This is one of the most important difference between saving and investment.

- When you put your money in a savings account, you get interested in your deposit. It means that the bank is giving you an additional amount for giving them your money for business and further investment.

- Contrarily, when you invest your money, you get profits or returns. It may vary with each investment. For example, The Yard Marketing is giving its valued customers estimated annual returns depending on their initial investment, making it one of the most sought-after investments in Pakistan.

The Yard Marketing has pledged to MNO to develop the best investment solutions for our clients. By considering real estate’s ROI, it is safe to say that real estate comes with huge investment benefits. So, these were one of the major difference between saving and investment. Both have their pros and cons.

Now, the question is….

But where do you spend your money? what’s the difference between saving and investment?

Well, honestly, the choice is all yours. It depends upon your capital, future goals, and personal preferences. For example, there are advantages and disadvantages of saving money. You get low returns and slow growth, but savings also come with low risk. Having said that, before putting your money in any of these options, try to understand how these work and how to save and invest money wisely. Nevertheless, savings and investment are of tremendous importance for economic growth.

Are you still trying to understand difference between saving and investment? We suggest you to start investing your money for the best times? Contact us at +923 11 11 33 822.